Contents:

There was a diversity of views among https://forexaggregator.com/ countries, as well as Australia, Canada, and Japan, which enriched the debate. These success stories were particularly remarkable in the light of the failures of international political and economic cooperation in the 1930s. In any case, there has never been another moment in the history of international cooperation that matches the end of the Second World War and the early post-war years.

- The Smithsonian Agreement is what they came up with, but it proved too little, too late.

- This is the dilemma facing all governments that pursue the contradictory and self-defeating policies of mercantilism and inflationary finance.

- While not every country has signed on to the Basel Accords, most countries with international banks still follow the Basel capital standards.

- A few countries retained the gold standard for a few more years, but the most important of them, France, finally abandoned it in 1936.

The https://trading-market.org/ discourages excessive use of its resources by levying a surcharge on large loans, and countries are expected to repay loans early if their external position allows them to do so. Immediately, on Monday, the Dow Jones Industrial Average rose by about 4% for the first time in its history, and the volume of trading on the American Stock Exchange recorded a record 31.7 million shares. The market continued to rise for about a year and a half, and despite the end of the “gold standard”, the economy witnessed a relatively moderate rate of inflation during that period.

For a quick property sale, check out https://www.cash-buyers.net/virginia/cash-buyers-for-houses-staunton-va/

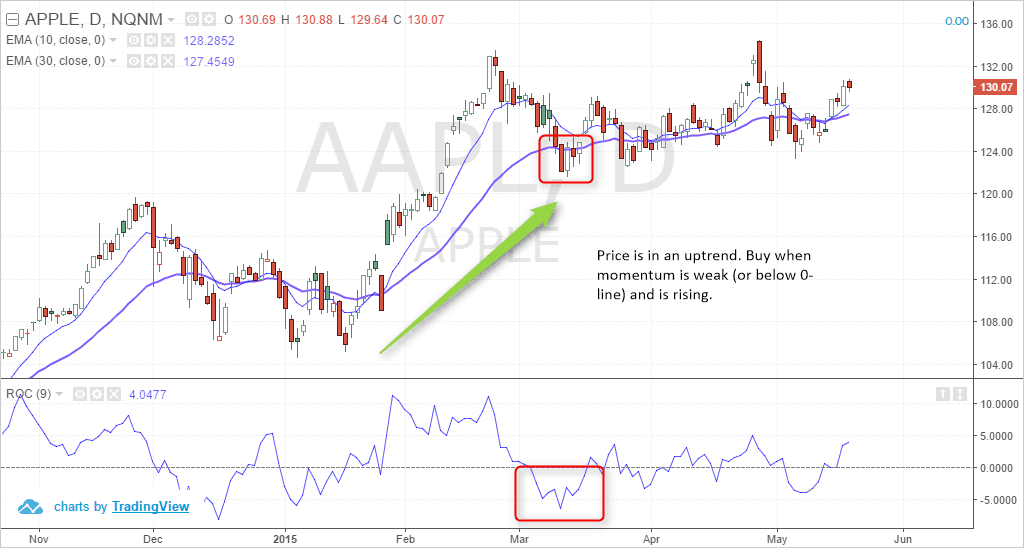

Market Overview:

The International Bank for Reconstruction and Development, now known as the World Bank Group, was responsible for providing financial assistance for the reconstruction after World War II and the economic development of less developed countries. A major point of common ground at the Conference was the goal to avoid a recurrence of the closed markets and economic warfare that had characterized the 1930s. Thus, negotiators at Bretton Woods also agreed that there was a need for an institutional forum for international cooperation on monetary matters. Already in 1944 the British economist John Maynard Keynes emphasized “the importance of rule-based regimes to stabilize business expectations”—something he accepted in the Bretton Woods system of fixed exchange rates. Currency troubles in the interwar years, it was felt, had been greatly exacerbated by the absence of any established procedure or machinery for intergovernmental consultation.

The birth of inflation targeting: why did the ERM crisis happen? – Economics Observatory

The birth of inflation targeting: why did the ERM crisis happen?.

Posted: Tue, 08 Nov 2022 08:00:00 GMT [source]

If domestic dreams of nations today are pursued by resorting to the insidious schemes of inflationary finance, they will inevitably become the international nightmares of tomorrow. U.S. could afford to extend foreign aid , loans at below market rates of interest , and military protection , to those countries in need. Bretton Woods is dead and an autopsy is called for to determine the cause of death. If meaningful international monetary reform is to follow, it is necessary to know what went wrong. As mentioned above, 44 allied nations met in Bretton Woods, NH in 1944 for the United Nations Monetary and Financial Conference.

???? Understanding the Bretton Woods Agreement

Then, after the failure of Anglo Irish https://forexarena.net/ in January 2009, spreads increased across the Eurozone reflecting the increased vulnerability of the financial systems of all the member countries. The USD works as the international reserve currency to compensate for the short supply of gold. “During the agonizing 18-month recession, unemployment reached as high as 10 percent and GDP shrunk by a whopping 4.3 percent. The economy only turned around after massive government stimulus spending (more than $1.5 trillion) to prop up the failing banks and inject capital into the shell-shocked economy.” history.com In fact the crash was much more than a US one. The world economy was pushed into recession, with knock-on consequences including the Arab Spring, ‘austerity’ for the working class and a further decline in productive investment.

Unlike national economies, however, the international economy lacks a central government that can issue currency and manage its use. In the past this problem had been solved through the gold standard, but the architects of Bretton Woods did not consider this option feasible for the postwar political economy. Instead, they set up a system of fixed exchange rates managed by a series of newly created international institutions using the U.S. dollar as a reserve currency.

At that time, the world economy was very shaky, and the allied nations sought to meet to discuss and find a solution for the prevailing issues that plagued currency exchange. At the Smithsonian meeting, the United States agreed to devalue the dollar against gold by approximately 8.5 percent to $38 per ounce. Other countries offered to revalue their currencies relative to the dollar. The net effect was roughly a 10.7 percent average devaluation of the dollar against the other key currencies . In December 1971, monetary authorities from the world’s leading developed countries gathered in Washington, DC, in an ultimately unsuccessful attempt to rescue the Bretton Woods global monetary system. The decision by President Nixon to “close the gold window” was the end of the U.S. commitment to set a fixed price for gold.

3.1 Emergency Import Restrictions to Address Balance of Payments Problems

But thanks to Bretton Woods, it did not take long before the tide was tilted in favor of the dollar, which managed to overtake sterling for the first time in 1955 to become the world’s number one reserve currency. Since then, the dollar has held its ground without any threat from any potential competitor . Thus, the Americans strengthened the position of the dollar as a medium of international exchange . 1- The application of the gold rule in developing countries in general is one of the factors behind their backwardness. Despite hundreds of participants, the Bretton Woods agreement was in fact a struggle between two men in the battle to transfer global economic hegemony from Britain to the United States. The British were represented by the well-known economist “John Maynard Keynes” who was spotted as the most famous participant, while the Americans were represented by the mysterious official of the Treasury, “Harry Dexter White.”

- This worldwide trend was reinforced by the multiplication and expansion of offshore financial centres.

- This article analyses a number of viewpoints of the cause of the breakdown of the Bretton Woods system from various papers and presents a conclusion based on the evaluation of the validity of these views according to the historical context.

- George Shultz succeeded Connally as Treasury Secretary, and Nixon developed great confidence in Shultz’ economic advice.

- Then after the bailout, bank CDSs should decline and sovereign CDSs should rise.

Gold’s price spiked in response to events such as the Cuban Missile Crisis, and other less significant events, to as high as $40/ounce. The Kennedy administration drafted a radical change of the tax system to spur more production capacity and thus encourage exports. This culminated with the 1963 tax cut program, designed to maintain the $35 peg. It was envisioned that these changes in exchange rates would be quite rare.

Handbook of International Economics

Recovery in Europe, and particularly in Germany, was viewed as essential, and so the United States gave extensive loans to European countries. When the worst harvest of the century and the most severe winter followed one another in 1946 and 1947, problems were exacerbated. In Europe, foreign exchange reserves had been nearly exhausted and a desperate shortage of dollars and gold developed. However, the uncooperative behavior of European countries may not be wholly held responsible for the depreciation of USD, which ultimately resulted in the failure of the Bretton Woods system.

The dollar could bring investors a nasty surprise – Yahoo Finance

The dollar could bring investors a nasty surprise.

Posted: Thu, 12 Jan 2023 08:00:00 GMT [source]

At the time, countries had to settle their debts in dollars with $35 being equal to an ounce of gold. This speculative capital outflow caused the U.S. balance of payments deficit to increase in a pyramiding fashion. Finally, the conspicuously low amount of U.S. gold reserves, the disparity between currencies and interest rates, and a dwindling U.S. trade surplus, aroused a well-founded suspicion that the dollar might be devalued — and that other, stronger currencies might appreciate in value.

Under President Franklin Roosevelt’s administration, the country withdrew from the “gold standard” system in 1933 in a last-ditch effort to revive economic growth. In the fifties, the sterling area controlled half of world trade, while sterling represented more than half of the world’s foreign exchange reserves. If anyone had said that the outcome of this unilateral decision would be greater international cooperation, no one would have believed it. But Nixon masterfully created a situation where suddenly countries understood that they needed coordinated policies to deal with finance, trade, energy, and food. We entered a period of enormous international cooperation on the heels of this very tough decision that Nixon made at Camp David.

After the end of World War II, the U.S. held $26 billion in gold reserves, of an estimated total of $40 billion (approx 65%). As world trade increased rapidly through the 1950s, the size of the gold base increased by only a few percentage points. The first U.S. response to the crisis was in the late 1950s when the Eisenhower administration placed import quotas on oil and other restrictions on trade outflows. However, with a mounting recession that began in 1958, this response alone was not sustainable. In 1960, with Kennedy’s election, a decade-long effort to maintain the Bretton Woods System at the $35/ounce price began.

The shift toward a more pluralistic distribution of economic power led to increasing dissatisfaction with the privileged role of the U.S. dollar as the international currency. Acting effectively as the world’s central banker, the U.S., through its deficit, determined the level of international liquidity. In an increasingly interdependent world, U.S. policy significantly influenced economic conditions in Europe and Japan.